Smart Bank Transfer

Just as card payments can be enhanced with Blue documents, bank transfers can also be transformed from simple money movements into conditional, programmable transfers with built-in verification and multi-party confirmation. Examples from Card Payment and Payment Plan also apply to bank transfers, however, smart bank transfers could be particularly transformative for B2B agreements.

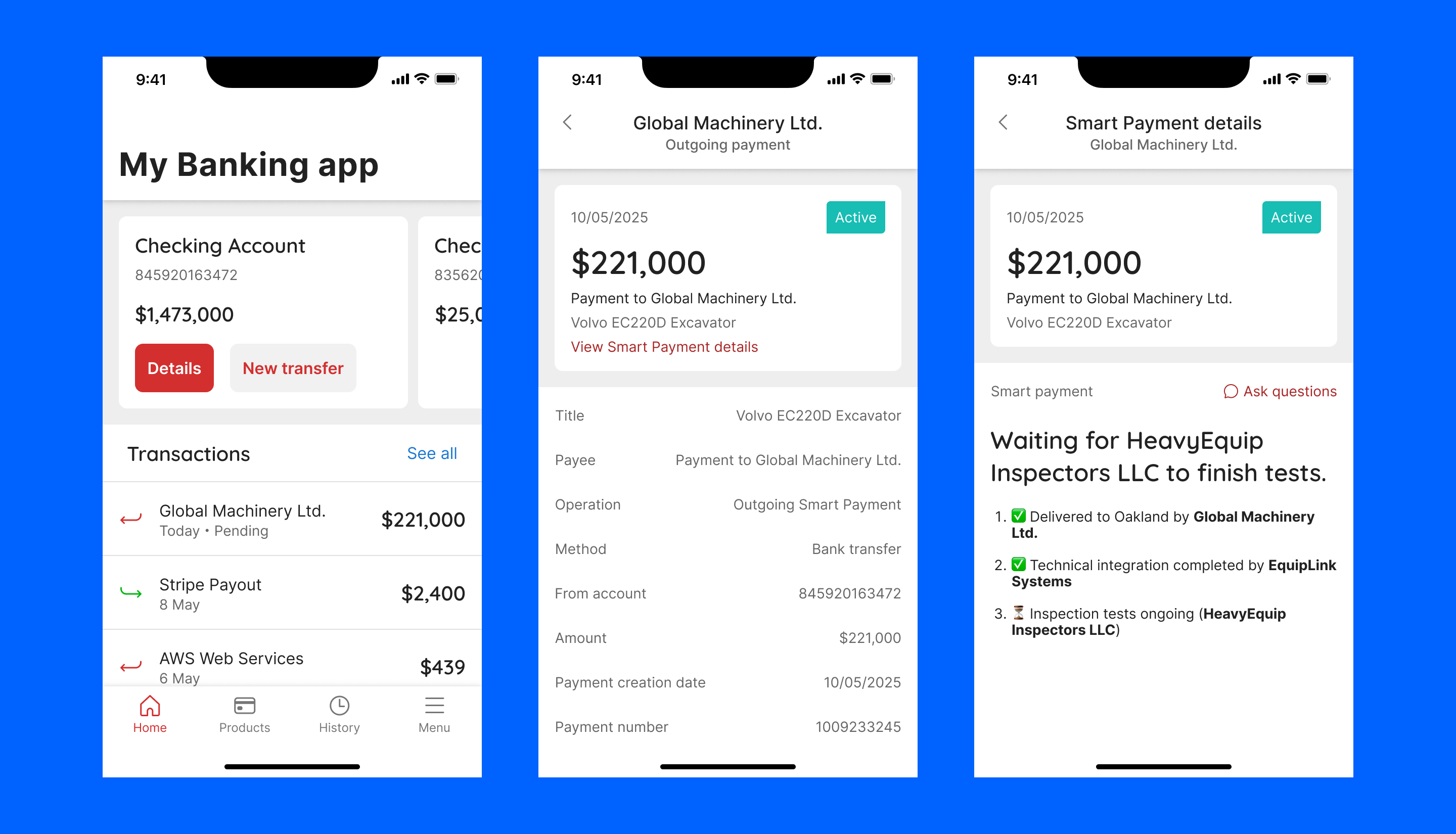

Example: Buying a Volvo Excavator

Consider a construction company purchasing a $220,000 Volvo excavator from a supplier. Rather than using complex escrow arrangements or negotiating who bears the payment risk, they create a smart payment with conditions guaranteed by their bank:

The payment document specifies three verification requirements before funds are released:

- Delivery to Oakland by Global Machinery Ltd.

- Technical integration completion by EquipLink Systems

- Inspection tests by HeavyEquip Inspectors LLC

When the payer initiates this smart transfer, the bank confirms the funds are available and commits to following the payment rules. The payer can then share this payment document with the supplier. The main payment document includes the payer, the payee, and the bank as direct participants.

The payment document contains three embedded documents, each with its own set of participants including the relevant verification company. As these companies complete their tasks and update their respective documents, the main payment automatically tracks completion status. The bank simply guarantees it will execute the payment rules as defined in the document—much easier than traditional escrow arrangements where banks must manually verify specific conditions. This automation makes smart transfers significantly cheaper to offer at scale.

The bank app becomes much more than a transaction tool. The CEO sees not just that money is pending, but the precise status of each verification requirement. This creates unprecedented transparency in complex B2B transactions, reducing risk for all parties while maintaining the security of traditional banking.

When all conditions are finally met, the CEO receives a notification that payment will process automatically, but can choose to release it immediately:

Initiating Smart Bank Transfers

There are several ways these enhanced transfers could be implemented:

- For banks providing APIs, it could leverage the /blue endpoint, making it accessible to developers

- Banks could offer a MyOS Agent that handles the integration seamlessly

- Most naturally, banks could enable customers to initiate such transfers directly from their banking app or web interface, either by:

- Uploading a prepared Blue document (perhaps created by legal counsel)

- Using the bank's AI assistant to generate an appropriate document based on natural language explanation, similar to how it's handled in MyOS

Once initiated, the payer can share the payment document with other participants, allowing them to track status and fulfill their verification responsibilities.

Transforming Banking Apps into Business Tools

These smart transfers fundamentally change the relationship between businesses and their banking tools. Banking apps transform from simple financial ledgers into comprehensive business intelligence platforms that provide:

Enterprise Relationship Management

For CFOs and CEOs, their banking app now shows not just transaction amounts but relationship status across their business ecosystem. The app becomes the first place executives check to understand:

- Status of major equipment purchases

- Verification progress from multiple vendors

- Upcoming conditional payment triggers

- Documentation completeness across complex deals

Risk Reduction Through Smart Rules

Unlike traditional escrow that requires costly manual administration, smart transfers operate on predefined rules that execute automatically when conditions are met. This dramatically reduces:

- Administrative costs for the bank

- Time delays in transaction processing

- Risk of miscommunication about requirements

- Need for manual intervention and verification

For banks, this means offering escrow-like security at regular transfer prices, opening this powerful capability to a much broader market of business transactions.

How Embedded Documents Enable Multi-Party Verification

The power of this approach comes from how Blue handles document composition. The main payment document establishes the overall transaction structure and includes the bank, payer, and payee. Inside this document are three separate embedded documents:

- Delivery Verification Document: Participants include Global Machinery Ltd., the payer, and the payee

- Technical Integration Document: Participants include EquipLink Systems, the payer, and the payee

- Inspection Document: Participants include HeavyEquip Inspectors LLC, the payer, and the payee

Each embedded document has its own timeline, rules, and participants. The verification companies only interact with their specific document, unaware of the overall payment structure. This separation provides clean interfaces while maintaining document integrity.

The main payment document monitors these embedded documents through Document Update Channels that detect when status changes. When all embedded documents reach their "completed" state, the main document initiates the payment release process.

This approach allows specialized verification providers to participate exactly where their expertise is needed, without requiring them to understand the entire payment flow or interact with systems outside their area of focus.

Beyond Simple Transfers

These smart bank transfers enable sophisticated business orchestration:

- Construction projects with staged payments to multiple subcontractors

- Manufacturing partnerships with quality-based payment adjustments

- International trade with regulatory and customs verification

- Technology implementations with performance-based compensation

By implementing these smart transfers, forward-thinking financial institutions can position themselves at the center of the trust ecosystem, creating new value-added services that generate revenue while delivering unprecedented control and transparency to their business clients.