Blue PayNote

Blue PayNote enables AI agents to make payments within precisely defined boundaries without requiring access to your actual payment credentials. Like handing your child $20 with specific instructions to buy only vegetables, PayNotes create bounded payment authorizations that both the agent and merchant can verify.

The Problem

AI agents can already search, negotiate, and fill shopping carts, but we don't want to hand them our card numbers, bank tokens, or crypto wallets. We need a way to delegate just enough payment power—no more, no less—while keeping humans (or higher-order agents) in control of value and risk.

The Idea�

Picture sliding a $20 bill into an envelope and writing on the flap: "Only spend this on vegetables."

A Blue PayNote is that envelope—only digital, cryptographically signed, and machine-readable. The "bill" inside can be:

- A reserved card authorization

- A prepared bank transfer

- A BTC-UTXO

- Or just a promise backed by the issuer's reputation

The text on the flap is code written in Blue—the same language used across Card Payments and Smart Transfers. It defines tasks, checks, and workflows that must be satisfied before the funds move.

How PayNotes Work

The PayNote Lifecycle

- Issuer drafts the note – sets

maxValue, listspayeeTasks, picks apaymentMethod - Issuer assigns the agent – separate

assignAgentoperation signs the note into force - Agent presents note to merchant – via web widget,

/blue, or MyOS - Merchant evaluates and accepts – provides their timeline ID which the agent adds as

payee - Payee fulfills tasks – uploads documents, confirms details, provides evidence through their timeline

- Workflows & embedded docs validate – processing the submitted evidence and emitting either positive or negative events

- Settlement fires – the chosen

paymentMethodexecutes once all tasks are cleared - Note finalizes – status flips to Paid

PayNote in Action: Real-World Applications

iPhone Shopping Assistant

- Problem: Alice wants her AI assistant to not only search for but actually purchase an iPhone 16, 256GB, Alpine Blue if it finds one within her budget, but doesn't want to share her payment credentials.

- Payee Tasks: Merchant confirms exact product specifications match requirements.

- Payment Method: Card Payment through MyOS Payment Agent with automatic processing.

Bulk Business Supply Order

- Problem: Large Polish e-commerce platform uses AI agents to continuously restock inventory, negotiating with EU suppliers for pre-approved products but requiring financial guardrails without slowing down operations.

- Payee Tasks: Supplier must provide standardized order confirmation document and quality certification.

- Payment Method: Automatic bank transfer once documentation is approved.

Used Camera Purchase with Visual Verification

- Problem: Professional photographer wants to find a used medium-format camera in excellent condition, but needs verification of its state before committing to the purchase.

- Payee Tasks: Seller uploads detailed images and operational video; independent AI Agent analyzes and confirms condition meets requirements.

- Payment Method: Blue document from a crypto custodian, cross-embedded with the PayNote, handling the automatic cryptocurrency payment when verification completes.

How PayNotes Are Used

PayNotes can be integrated into various systems and platforms, enabling AI agents to make authorized purchases across different environments.

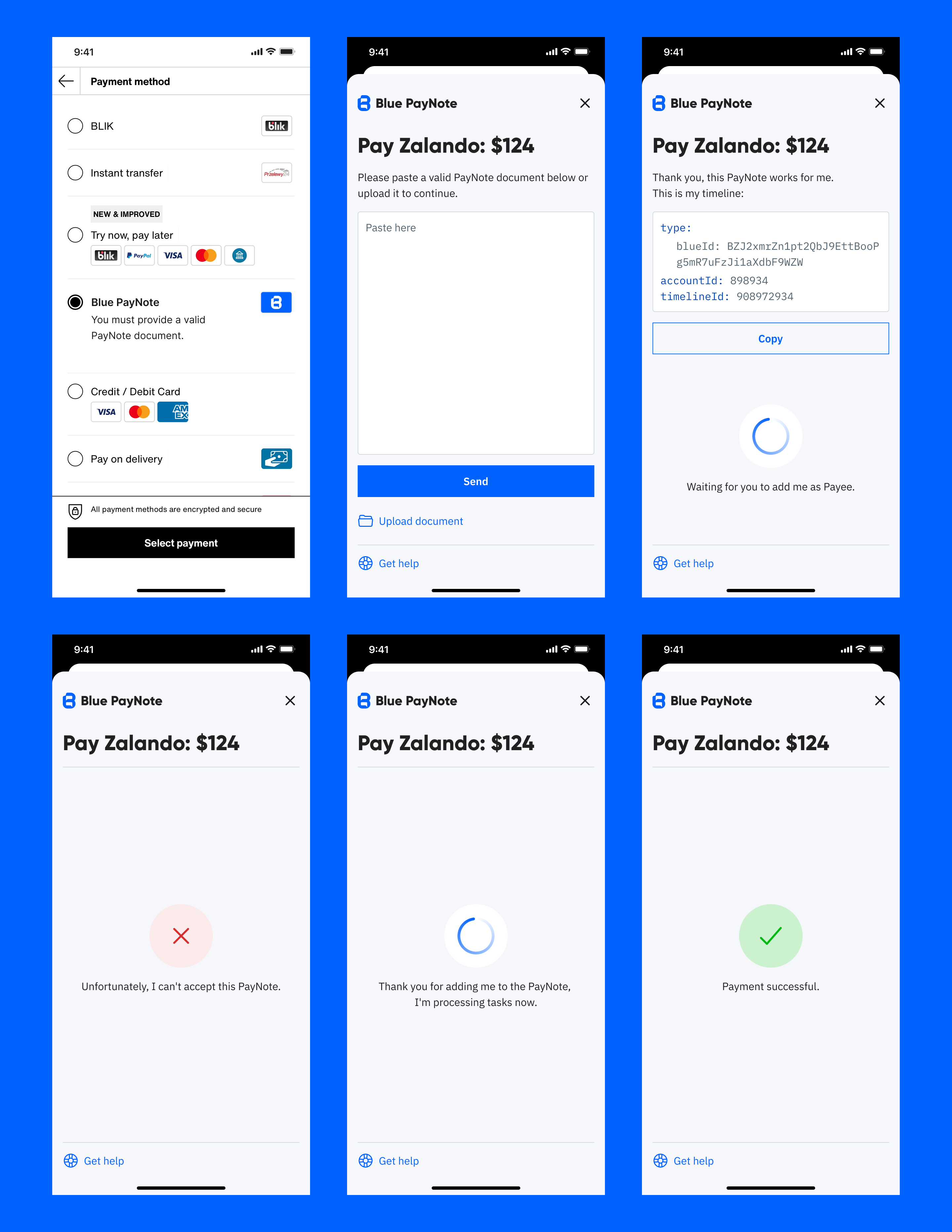

Website Payment Method

The simplest integration is adding PayNote as a standard payment method at checkout alongside options like Visa, Mastercard, and PayPal:

- Agent selects "Pay with Blue PayNote" at checkout

- Agent provides the complete PayNote document

- Merchant reviews the PayNote conditions and decides if they can fulfill requirements

- If accepted, merchant provides their timeline identifier

- Agent adds merchant timeline as the Payee in the PayNote

- Website displays "Payment Processing" status while verification tasks are completed

- Once all tasks are verified and payment executes, the website confirms successful payment

This approach allows AI agents to browse any e-commerce site, navigate product pages, complete checkout forms, and use PayNotes as payment without the website needing to understand Blue's technical details.

/blue Endpoint for Advanced Integration

For more sophisticated interactions, services can implement the /blue endpoint allowing agents to conduct structured negotiations:

Instead of following a rigid checkout flow, agents can engage in back-and-forth conversations about product details, shipping terms, additional services, and payment conditions. PayNotes can be embedded within these negotiations as payment guarantees, enabling complex conditional transactions.

For example, an AI agent might say: "I'm interested in the iPhone 16, Alpine Blue, 256GB. I can pay $528 - here is my PayNote with guaranteed bank payment. If you can sell for this price, let's create an Order document and I will embed this PayNote and it will auto execute once courier confirms the product is shipped."

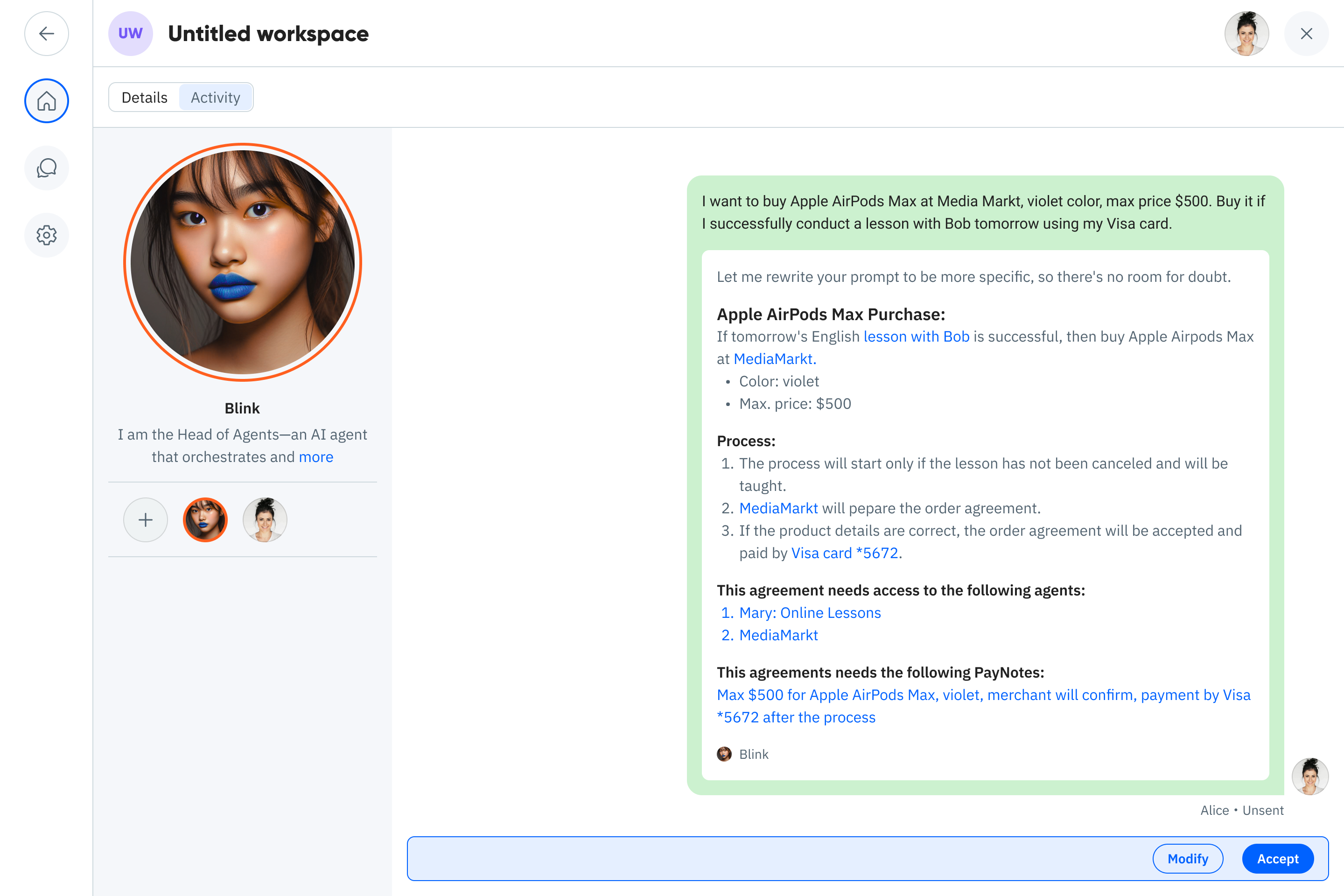

MyOS Integration

Within the MyOS ecosystem, PayNotes integrate seamlessly into workspaces and agent interactions:

- Users can instruct agents to complete tasks with attached PayNotes for payment

- Agents can negotiate with service providers within workspaces

- PayNote verification and settlement happens automatically within the platform

- Payment status updates appear directly in workspace activity feeds

This approach is particularly powerful for ongoing relationships where multiple tasks might be delegated to different agents, each with their own payment authorization.

Why PayNotes Matter in the AI Economy

Autonomous agents will soon execute thousands of micro-transactions for us. Blue PayNote gives each of them a narrow, self-documenting payment lane—strong enough to be trusted, but too narrow to be abused.

- Security – No raw card numbers or bank credentials leak to agents

- Auditability – Every note is a tamper-evident doc with a full Timeline

- Flexibility – Same mechanism covers prepaid, credit, or pure IOU scenarios

- Composable – Tasks, workflows, and third-party attestations snap together

Deep Dive: The Alice iPhone Case

Let's explore three different ways Alice could use a PayNote to purchase an iPhone 16, all using MyOS as the infrastructure for timelines and coordination.

Approach 1: Simple Shop Confirmation with Automated Bank Payment

In this scenario, Alice wants a straightforward verification where trusted shops simply confirm the product matches her requirements, combined with automated payment.

PayNote Setup:

- Agent can invite only trusted electronics retailers as payees

- Simple "yes/no" confirmation of product specifications

- Smart Bank Transfer for automatic payment

Implementation Details:

- Alice creates a PayNote and limits acceptable payees to a list of trusted merchants

- She then goes to her bank and asks the AI assistant to create a Smart Bank Transfer with guaranteed funds to be triggered when this PayNote has tasks completed

- She embeds what her bank gives her into the PayNote itself

These steps can be done manually using a notepad or any programming language of her choice, or using MyOS for creating such a PayNote.

- Once ready, she assigns her shopping agent to this PayNote

- When her shopping agent finds the best price, it adds the merchant as payee (merchants outside the trusted list are rejected)

- Merchant confirms the product matches specifications through their timeline

- All tasks clear automatically, triggering the embedded Smart Bank Transfer

- Once payment is completed, PayNote status updates to "Paid"

Approach 2: Structured Data Verification with Cryptocurrency Settlement

In this approach, Alice requires more rigorous verification with structured order data and cryptocurrency payment.

PayNote Setup:

- Merchant must provide structured order details in specific format

- Coinbase-backed payment for automatic cryptocurrency settlement

Implementation Details:

- Alice creates a PayNote with structured data verification requirements

- Similarly to before, she cross-embeds a Coinbase-backed payment document with this PayNote, so that payment is triggered once tasks are done, and PayNote moves to "paid" once payment is confirmed

- Her shopping agent negotiates with retailers and selects the best option

- The merchant provides structured order details through their timeline

- A workflow automatically validates the data against Alice's requirements

- When all tasks clear, the Coinbase payment document automatically executes

- PayNote status updates to "Paid" when the cryptocurrency transaction confirms

Approach 3: Second-hand Purchase with Video Verification

For a used iPhone purchase, Alice implements sophisticated video verification with AI analysis.

PayNote Setup:

- Seller must provide HD video showing device condition and functionality

- MyOS Agent backed by GPT-4o must verify video authenticity and assess condition

- Manual card payment after verification

Implementation Details:

- Alice creates a PayNote through MyOS workspace and also requires her Payment Agent to prepare a confirmation for merchants that she has a card added and has a clean payment record from previous PayNotes

- Her shopping agent finds a suitable used iPhone from a private seller

- The seller uploads a video showing the phone from all angles, turning it on, and demonstrating key features

- Opening Settings shows expected parameters for the device

- A MyOS Vision Agent powered by GPT-4o analyzes the video to verify:

- The phone is genuinely an iPhone 16, Alpine Blue, 256GB

- The screen has no visible damage

- If the AI approves, Alice receives a notification to complete payment

- Alice manually completes payment through MyOS

- PayNote status updates to "Paid" once payment confirmation is received